Resident Status in Malaysia

Permanent Residency Status in Malaysia is granted to Any Foreign Citizen under the Immigration Act and Regulations 195963. Check your eligibility for PR status.

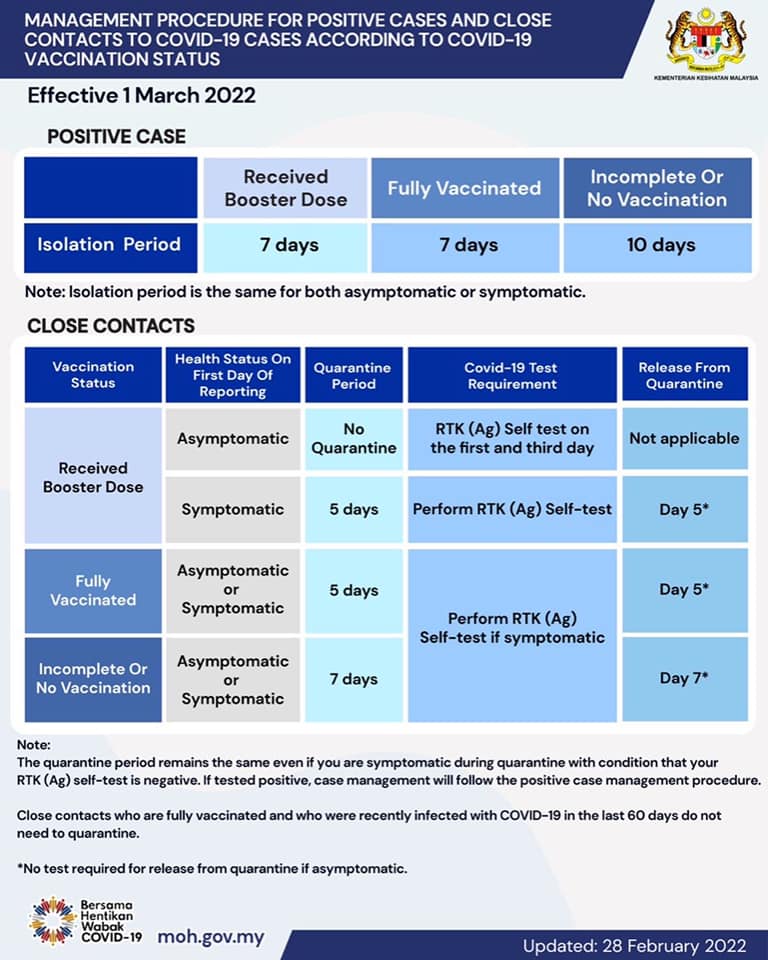

Protocols For All Travellers Entering Malaysia From 1 April 2022

Determination of Residence Status.

. The residence status of subsidiaries of foreign corporations would be determined by paragraphs 81b and 81c of the ITA 1967. The very first requirement to apply for PR status is a person must live in Malaysia for a minimum five consecutive years. In Malaysia or registering a branch in Malaysia.

Residence Pass is a pass issued to any foreign national who falls under any category specified under Regulation 16A Immigration Regulations 1963. Generally residence status for tax purposes is based on the number of days spent by the individual in Malaysia and is independent of citizenship. In Malaysia in a tax year for 182 days or more.

If in doubt contact the Immigration Department. Resident status is determined by reference to the number of days an individual is present in Malaysia. Another advantage of the resident status is that deductions.

1 For the purposes of this Act an individual is resident in Malaysia for the basis year for a particular year of assessment if a he is in Malaysia in that basis year for. 32 Resident individual is an individual resident in Malaysia for the basis year for a year of assessment as determined under section 7 and subsection 71B of the ITA 1967. Gather all the paperwork and approvals required for your.

A persons residency status is determined based on the number of days he is physically present in Malaysia in a year. Significance of Residence Status 41 Residence status is a question of fact and it is one of the main criteria that determines the tax treatment and tax consequences of a company or body of. Note that spending part of a.

Any Foreign Citizen which had been granted with Permanent. A company is tax resident in Malaysia in a basis year normally the financial year if at any time during the basis. Generally residence status for tax purposes is based on the number of days spent by the individual in Malaysia and is independent of citizenship.

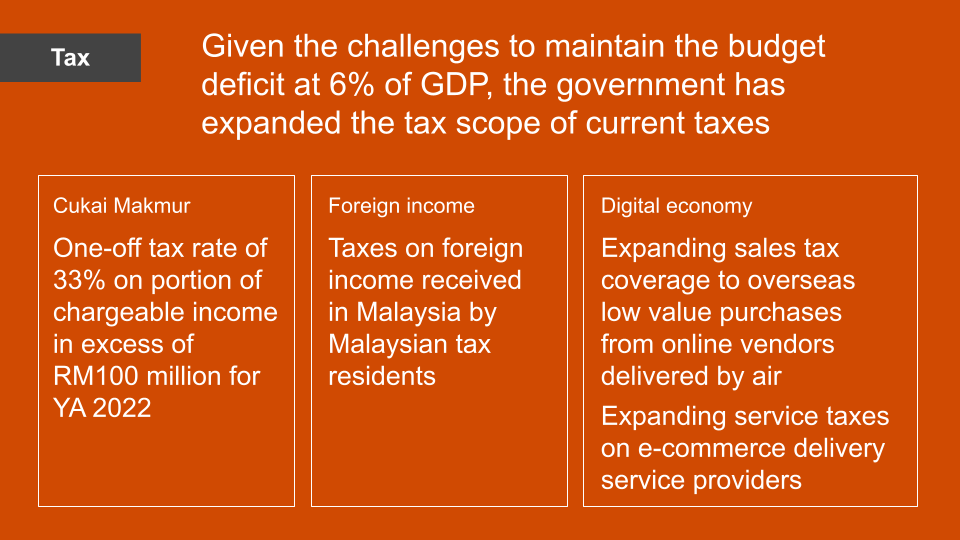

CATEGORY 4 - A. Generally an individual who is in Malaysia for a period or periods. Non-residents pay a flat 28 on taxable income so it is advantageous for your employee to qualify as a resident.

There are four rules to determine tax resident status of an individual in Malaysia. A company is resident in Malaysia if at any time during that basis year the management and control of its business is in Malaysia. Last reviewed - 13 June 2022.

Malaysia Permanent Resident Requirements. Resident status in Malaysia Section 7 1 a No of days in month- 2014 not leap year Single period Multiple Period summary cont RESIDENT STATUS IN MALAYSIA NOOR. Corporate - Corporate residence.

In Malaysia for less than 182. Here are the basic steps to follow². For instance under Section 71a of Income Tax Act ITA 1967 if he.

Procedures For Travellers Entering Malaysia From 1 April 2022 News From Mission Portal

Procedures For Travellers Entering Malaysia From 1 April 2022 News From Mission Portal

Procedures For Travellers Entering Malaysia From 1 April 2022 News From Mission Portal

Comments

Post a Comment